Table of Contents

, there are several aspects to look for, including debt monitoring, identification surveillance, identity burglary recovery and insurance policy and more. They look for indications of identity burglary, such as sudden rating motion and unforeseen credit score questions. When they see these indications, they signal the individual so they can take activity and file a report.

The policy might have an insurance deductible or other exclusions or limitations; most don't cover anyone already covered by tenants or home owners insurance, which is why it's crucial to always review the great print. If your property owners or occupants insurance coverage already covers identification theft, then the insurance coverage from your identity theft defense service may not use

Some Known Factual Statements About Identity Protection Tools

: Lastly, we have a look at where the company is based to see what surveillance laws it drops under. For companies based in the United States, they might be forced to share consumer data as a result of the U.S's subscription in Five Eyes, Nine Eyes and 14 Eyes. This will only occur in unusual situations.

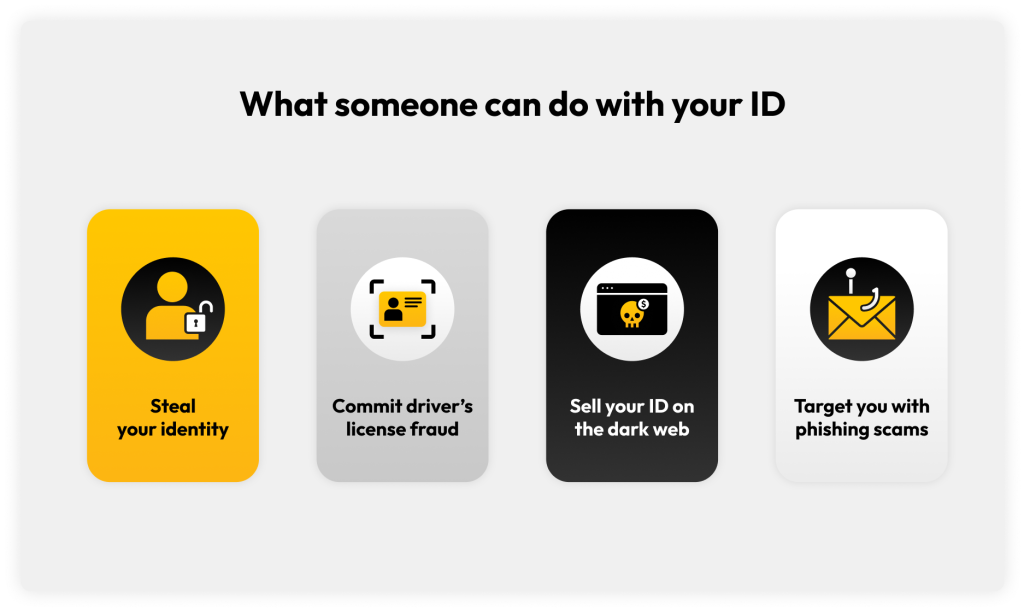

Yes, somebody can steal your identification with your government-issued ID or vehicle driver's license. (PII) including your complete name, home address, day of birth, image or even your signature can be utilized to take your identity and target you with phishing frauds.

Picture your chauffeur's permit number becomes jeopardized and drops into the hands of somebody that makes duplicates of your ID and afterwards offers them to criminals. If a criminal gets captured for any type of criminal offense with your ID, police can put those charges on your document rather than theirs. This situation is extremely harmful because it will be testing to show that you didn't commit those crimes since one more person has your ID.

An Unbiased View of Identity Protection Tools

If someone has your ID, they can use your full name to look you up and discover your e-mail address or telephone number. Once they have methods to contact you, a person might send you a fake message regarding questionable activity in your checking account or a problem with a social networks profile.

You can tell if someone is using your lost or swiped ID for harmful functions by seeing the following: A brand-new finance or line of credit report that you did not license appears on your credit history report, indicating that someone has actually utilized your ID to devote scams You can not visit to your on-line accounts, suggesting that someone used your ID and info linked with your ID to jeopardize your accounts You quit receiving mail, which can be an indicator someone has actually changed the address on your ID to match theirs You start getting phone calls from financial obligation enthusiasts concerning financial debt that isn't yours, implying someone has actually utilized your ID to pose you and been accepted for credit history cards or lendings Your bank alerts you of illegal activity, which means a person has used your ID to take out huge amounts of money or make unapproved purchases There are numerous things you should do if your ID has actually been lost or swiped, such as reporting the loss or burglary to your state's DMV, freezing your credit score and submitting a record with the Federal Trade Compensation (FTC).

You need to report your ID as stolen - learn more to the Federal Trade Commission (FTC), which will certainly utilize the details you supply to team up with law enforcement in exploring your identity theft. It is necessary to submit a report with the FTC as quickly as possible so the FTC can share your experience with regulation enforcement to aid recoup your identity and utilize the info from your case to assist shield others

Our tech group has years of experience with LifeLock, and we have become extremely knowledgeable about what they provide. Their most detailed plan, Ultimate And also, supplies substantial security and identity theft resolution services that need to cover the needs of a lot of seniors. We got message, phone, and mobile application notifies whenever there was a feasible data violation or misuse of our personal information.

10 Simple Techniques For Identity Protection Tools

Not all LifeLock plans, however, supply the very same level of security. The Requirement strategy is somewhat very little in its offerings, but you can still stand up to $1.05 million in identity burglary insurance policy, together with Social Safety and security number, credit history, and monetary surveillance. If you're not on a limited spending plan, you can get even more features with one of the costlier plans, such as: Protection for up to 2 adults Approximately $1 countless insurance coverage for legal charges (per grownup) As much as $1 million in personal expenditure compensation (per grownup) As much as $1 million in taken funds reimbursement (per adult) Approximately $3 million in total insurance coverage 3 credit report bureau tracking Payday lending lock to quit deceitful high-interest car loans Alerts for criminal activities devoted in your name Social media site tracking Financial and investment account tracking Telephone number security Home title surveillance LifeLock includes three identity burglary protection packages ranging from $11 - click here.99 to $69.99 monthly for the first year of solution

The Criterion plan, for example, sets you back $89.99 for the first year, and after that $124.99 for each year after that. With the addition of anti-virus solutions and high compensation quantities, however, LifeLock's cost is rather reasonable.

Navigation

Latest Posts

The 5-Second Trick For Identity Protection Tools

Rumored Buzz on Identity Protection Tools

Identity Protection Tools Can Be Fun For Everyone